Unit

3: The Case for Protection

Part

1: A Brief History of Protectionism in the U.S.

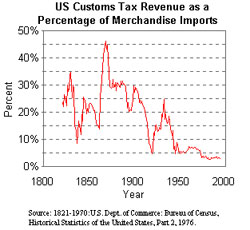

If it’s fine to

say that in theory protectionism doesn’t work, or

that it is less efficient than free trade, it’s also

true that protectionism has been an important part of the

American landscape. Most famously, the Boston Tea Party

acted out the North American colonists’ resistance

to a tax put on the tea Americans bought from then-monopoly

the British East India company. Moreover, one of the underlying

historical sources of tension between the antebellum North

and South was American import tariffs on manufactures, which

protected northern manufacturers and hurt southern plantation

owners. The dispute was so intense that the South insisted

the Constitution be drafted in such a way as to make it

illegal for the newly empowered federal government to collect

revenue through taxing southern cotton and tobacco exports.

Even so, revenues from import tariffs quickly became a significant

(and incredibly regressive) source of revenue for the US

government until the passage of federal income taxes in

the early 1900s.

|

|

|

***TIP

BOX: A regressive tax taxes the poor at a higher rate

than the rich. Because the poor spent nearly all of

their income on subsistence consumption—including

imports which had higher prices due to the tariffs—their

income was essentially being taxed at a higher rate

that the income of the rich, who could avoid such

taxes through their propensity to save. In fact, such

an argument can still be made today over state sales

tax—which explains why most states have low

or no sales taxes on grocery-store-bought food.*** ***TIP

BOX: A regressive tax taxes the poor at a higher rate

than the rich. Because the poor spent nearly all of

their income on subsistence consumption—including

imports which had higher prices due to the tariffs—their

income was essentially being taxed at a higher rate

that the income of the rich, who could avoid such

taxes through their propensity to save. In fact, such

an argument can still be made today over state sales

tax—which explains why most states have low

or no sales taxes on grocery-store-bought food.***

|

|

|

As

mentioned in Unit 1, the Industrial Revolution (late 1800s

- early 1900s) brought about what is commonly considered

the first wave of globalization, and with it came dramatic

reductions in US protectionist policy. But this did not

last. The onset of World War I and the inter-war Depression

Era that ensued saw dramatic increases in protectionism

with policies like the Smoot-Hawley Tariff Act. FDR’s

“New Deal” and passage of the 1934 Reciprocal

Trade Agreement Act helped to restore some openness to markets

with the introduction of the reciprocal Most Favored Nations

concept, but the outbreak of WWII put further steps toward

liberalization squarely on hold.

As

mentioned in Unit 1, the Industrial Revolution (late 1800s

- early 1900s) brought about what is commonly considered

the first wave of globalization, and with it came dramatic

reductions in US protectionist policy. But this did not

last. The onset of World War I and the inter-war Depression

Era that ensued saw dramatic increases in protectionism

with policies like the Smoot-Hawley Tariff Act. FDR’s

“New Deal” and passage of the 1934 Reciprocal

Trade Agreement Act helped to restore some openness to markets

with the introduction of the reciprocal Most Favored Nations

concept, but the outbreak of WWII put further steps toward

liberalization squarely on hold.

Since WWII, the level of protection—as defined by

the Global Agreement on Tariffs and Trade—has been

falling. Today’s import taxes are, on average, a bit

less than a typical American state’s sales tax. However,

this decline of protectionism in the US has not been consistent

across time or industry: it has proceeded in fits and starts

and differs systematically across industries.

For example, just after the formation of GATT in the 1950s,

tariffs fell dramatically as participants sought to avoid

a beggar-thy-neighbor episode such as occurred between the

two world wars. And although Europe sought increased protection

from US competition as they rebuilt in the ’60s, the

developed capitalist nations cooperated more fully late

in the decade, partly out of fear of the expanding Soviet

Empire. In the ’70s, oil shocks and the demise of

the dollar-backed Breton Woods Fixed Exchange Rate System

made protection fashionable again: it wasn’t until

the 1980s Tokyo Round of trade negotiations that GATT changed

to cover non-tariff barriers to trade and paved the way

for deeper integration in world trade zones in the ’90s—through

NAFTA, the EU, and South East Asia. Most recently, the war

on terror, the rise of Chinese manufacturing, and concerns

over the “outsourcing” of American jobs have

lent impetus once again to protectionist feelings, although

such feelings are sometimes inconsistently articulated and

followed.

The Bush administration’s flip-flop on steel tariffs

clearly exemplifies this inconsistency. When the administration

imposed tariffs on steel, they hoped to win battleground

states in the midterm elections in 2002—notably Ohio

and Pennsylvania. But in the last few months the administration

rescinded the tariffs—years before they were set to

expire—in part because they hurt American producers

who use steel as an intermediate good, in part because the

WTO declared them illegal, and in part because the European

Union threatened retaliatory sanctions against goods produced

in states even more important in the presidential election

next year—Florida among them. One lesson from this

episode in US trade policy: industry protection is frequently

proportional to industry political power.

To learn more about the US steel industry tariff case, listen

to the following series of audio clips which aired over

the days following the WTO’s ruling against the US.

AUDIO CLIP: NPR Audio: WTO Panel Rules

U.S. Steel Tariffs Illegal (11/11/2003)

http://www.npr.org/features/feature.php?wfId=1501551

AUDIO CLIP: NPR Audio: U.S. Steel Tariffs

Poised to End 12/1/2003)

http://www.npr.org/features/feature.php?wfId=1528224

AUDIO CLIP: NPR Audio: Steel Industry Faces

Economic Competition (12/01/2003)

http://www.npr.org/features/feature.php?wfId=1528226

AUDIO CLIP: NPR Audio: Steelworkers React

to Tariffs’ Removal (12/04/2004)

http://www.npr.org/features/feature.php?wfId=1532755

Other reasons for protecting industries include their historical

significance, labor intensity, and importance for national

security. Agriculture, which still receives generous subsidies

from the federal government, is an example of an industry

that is both labor intensive and historically significant.

During the ’80s, the “crisis of the American

farmer” was frequently described as the downfall of

a way of life—an appeal to its historical significance

and Americans’ identification with the rugged, earthy

values that it represents. Labor-intensive industries, moreover,

tend to draw protection because they need protection in

international labor markets, and because industry labor

intensity can be proportional to political significance—since

not protecting such industries leads to higher job loss

and more dissatisfied voters than failure to protect less

labor-intensive industries.

At bottom, history has shown protectionist sympathies tend

to grow in times of conflict or recession, and tend to be

associated with labor-intensive, politically, and historically

important industries. On the other hand, during times when

the Bretton Woods and GATT institutions (the IMF, World

Bank, and the WTO) are more or less supported, protectionist

sentiment falls.