Part 4: Brief History of Drug Regulation

Several laws were made mention of in the previous section that deserve further explanation. I will omit the details of local and state laws, which began to change before the federal laws, and focus only on the major federal laws.

Several laws were made mention of in the previous section that deserve further explanation. I will omit the details of local and state laws, which began to change before the federal laws, and focus only on the major federal laws.

1906 Food and Drug Act

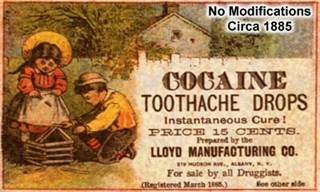

This is the first law that impacts drugs on a federal level. This law was in response to the "snake oil" sales of "cure-alls" which promised to cure most everything but did not provide a list of ingredients. Some of these cure-alls consisted of large amounts of morphine or alcohol. As a result, Congress passed the Food and Drug Act in 1906, which required the labeling of all ingredients in these patent medicines and cure-alls. Predictably, the result was a huge drop in the use of these substances once people knew what it is they were consuming. For example, one cure-all intended to cure tooth aches in children consisted almost entirely of cocaine.

1914 Harrison Tax Act

By 1914, various groups wanted to ban various drugs. Congress and most Americans at the time thought that a ban of any drug was unconstitutional as our constitutional guarantee of liberty gave us the right to consume any product we wished (which is why the prohibition against alcohol required a constitutional amendment rather than merely a law). The plan was to ban drugs by making them nearly impossible to obtain. The law required that you must pay a tax on drugs. To ensure that the tax was collected, you had to get the drugs from a doctor via prescription (all prescriptions were therefore registered with the tax office which enabled the government to track which doctors were prescribing which drugs). It is interesting to note that there was no agreement as to which drugs would be included in the tax act. Various regions pushed for different drugs. One of the candidates was caffeine. In the end the Harrison Act included opium, heroin, and cocaine (but not marijuana). The law required that (for tax purposes) doctors must keep records and only prescribe these drugs for "medical necessity." In 1919 the Supreme Court ruled in Webb, et. al. v. United States that addiction was not a disease; as a result doctors were told there was no "medical necessity" for these drugs. Since all doctors prescribing these drugs had provided records of these prescriptions, thousands of doctors were then arrested for prescribing these drugs to addicts to maintain their habits. Constitutionally, this was questionable as regulating the medical practice is thought to be a state issue.

1970 Controlled Substances Act: (Nixon's Drug War)

By 1970 the prevailing view that the constitution guaranteed us the liberty to use drugs had changed. As a result, Congress, with President Nixon's support (FBI Chief Hoover informed Nixon that the way to attack the "new left" was to arrest them on drug charges since the protests and anti-war speech were legal), passed the Controlled Substances Act of 1970. This act was more than just a banning of particular drugs, but also took the power to determine the legal status of future drugs out of the hands of the president, Congress, and courts. Instead, the power to determine the legal status of drugs was given to the DEA. New drugs never go to Congress for a vote; they are simply classified via " Scheduling " without debate by the DEA.

By 1970 the prevailing view that the constitution guaranteed us the liberty to use drugs had changed. As a result, Congress, with President Nixon's support (FBI Chief Hoover informed Nixon that the way to attack the "new left" was to arrest them on drug charges since the protests and anti-war speech were legal), passed the Controlled Substances Act of 1970. This act was more than just a banning of particular drugs, but also took the power to determine the legal status of future drugs out of the hands of the president, Congress, and courts. Instead, the power to determine the legal status of drugs was given to the DEA. New drugs never go to Congress for a vote; they are simply classified via " Scheduling " without debate by the DEA.

Scheduling

WEBLINK: Details about scheduling can be found at:

http://www.usdoj.gov/dea/pubs/scheduling.html

Each drug is scheduled by the DEA as it is "perceived."

Schedule I

Any drugs that have a "high potential for abuse" and that have "no currently accepted medical use in treatment in US" and whose "safety is not proven for medical use" are schedule I drugs. They include:

- Heroin

- Methamphetamine

- Marijuana

- LSD

In addition, no research can be done on Schedule I drugs without government approval.

As you can see it is very easy for a new drug to be classified as Schedule I. Any new drug that is "perceived" by the DEA as likely be abused and that is so new that there is no currently accepted medical use for it and that you can't prove to be safe gets a Schedule I rating. Once a drug becomes a Schedule I drug, how could you prove it is safe, develop a medical use for it, and show that the perception of abuse is false since you cannot do any research without government approval? When we combine this with the historical facts that many of the motivations for making these drugs illegal stem from racial factors (Chinese and opium smoking, Mexican migrants and marijuana, African-Americans and cocaine), it becomes difficult to justify our current drug laws. However, philosophers can employ moral arguments that may justify the legal prohibition of these drugs. We will begin with the case against drug use.

As we have seen there is a long history of taxing drugs. This continues as, despite our laws prohibiting drug possession, sale, and use, some states (including North Carolina ) still have laws taxing illegal drugs. Yes, this means that though you aren't supposed to have any drugs around, if you do have them you are required to pay a tax on them. The state tax law even prohibits state officials from turning you in for drug possession if you pay the drug tax. The following information is taken directly off of the official State of North Carolina website:

http://www.dor.state.nc.us/taxes/usub/substance.html

What is the unauthorized substances tax?

The unauthorized substances tax is an excise tax on controlled substances (marijuana, cocaine, etc.), illicit spirituous liquor ("moonshine"), mash, and illicit mixed beverages.

Who is required to pay the tax?

The tax is due by any individual who possesses an unauthorized substance upon which the tax has not been paid, as evidenced by a stamp.

When is the tax due?

The tax is payable within 48 hours after an individual acquires possession of an unauthorized substance upon which the tax has not been paid, as evidenced by a stamp.

Do I have to identify myself when I pay the tax?

No. Individuals who purchase stamps from the Department of Revenue are not required to give their name, address, social security number, or other identifying information.

What should I do with the stamps that I receive after I pay the tax?

The stamps must be permanently affixed to the unauthorized substance. Once the tax due on an unauthorized substance has been paid and the stamps affixed, no additional tax is due even though the unauthorized substance may be handled or possessed by other individuals in the future.

Will the Department of Revenue notify law enforcement if I purchase stamps to affix to my unauthorized substances?

No. Not withstanding any other provision of law, information obtained pursuant to the unauthorized substances tax law is confidential and may not be disclosed or, unless independently obtained, used in a criminal prosecution other than a prosecution for a violation of the unauthorized substances tax law. Revenue employees who divulge information regarding stamp purchasers to law enforcement shall be guilty of a Class 1 misdemeanor.

How are unauthorized substances tax collections used?

Seventy-five percent (75%) of the money collected is returned to the state or local law enforcement agency whose investigation led to the assessment. The remaining twenty-five percent (25%) of the money collected is credited to the General Fund.

If I purchase stamps, will I then be in legal possession of the drugs?

No, purchasing stamps only fulfills your civil unauthorized substance tax obligation. You will still be in violation of the criminal statues of North Carolina for possessing the drugs.

What number can I call to get an application for stamps or more information on the unauthorized substances tax?

1-877-308-9103

The state even provides tax rates for these drugs. The following is again taken directly from the State of North Carolina website: http://www.dor.state.nc.us/taxes/usub/usubrates.html

Unauthorized Substance Tax Rates

Substance |

Tax Rate |

Minimum Quantity |

Marijuana stems & stalks that have |

$.40 for each gram |

More than 42.5 grams |

Marijuana other than |

$3.50 for each gram |

More than 42.5 grams |

Cocaine |

$50.00 for each gram |

7 or more grams |

Any other controlled substance |

$200.00 for each gram |

7 or more grams |

Any other controlled substance |

$200.00 for each 10 dosage |

10 dosage units |

Any low-street-value drug |

$50.00 for each 10 dosage |

10 dosage units |

Illicit Spirituous Liquor |

$31.70 for each gallon |

No minimum |

Illicit Spirituous Liquor |

$12.80 for each gallon |

No minimum |

Mash |

$1.28 per gallon or |

No minimum |

Illicit Mixed Beverages |

$20.00 on each 4 liters |

No minimum |

In addition to this information, there is even an official state tax form for you to submit to ensure you've paid taxes on the drugs you have. It can be found online at http://www.dor.state.nc.us/downloads/BD-1.pdf or you can view a copy of that form here.